Remember the headlines from a few months ago? The IRS is getting an additional $80 billion over the next decade. Half of it is going to tax enforcement, but a fair chunk, roughly $25 billion, is going toward such things as “information technology development.”

What could possibly go wrong? The money devoted to technology is sorely needed.

A recent Government Accountability Office report reminds us why:

…GAO's analysis showed that about 33 percent of the applications [running on IRS computer systems], 23 percent of the software instances in use, and 8 percent of hardware assets were considered legacy. This includes applications ranging from 25 to 64 years in age, as well as software up to 15 versions behind the current version. As GAO has previously noted, and IRS has acknowledged, these legacy assets will continue to contribute to security risks, unmet mission needs, staffing issues, and increased costs. [emphasis added]

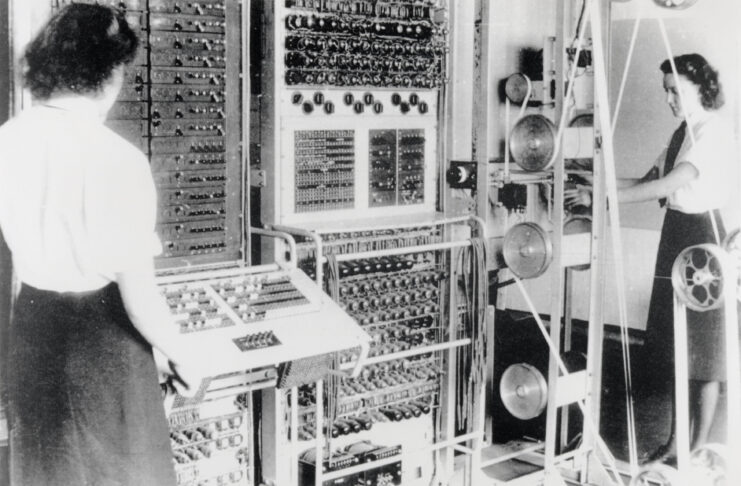

It's both astounding and horrifying to see that the IRS is running computer systems that are straight out of the 1950s. But it's true. And that reality is a huge personnel problem for the already troubled agency. The reason: there's a shortage of people in the world who know how some of these antiquated programs work. And the IRS is making it even more difficult to fix its tech problems:

IRS recently suspended operations of six initiatives, including two which are essential to replacing the 60-year old Individual Master File (IMF). The IMF is the authoritative data source for individual tax account data. GAO has reported that IRS has been working to replace IMF for well over a decade. According to officials, the suspensions were due to IRS's determination to shift resources to higher priorities; staff members working on these suspended initiatives were reassigned to other projects. As a result, the schedule for these initiatives is now undetermined. Accordingly, the 2030 target completion date for replacing the IMF that IRS announced last year is now unknown. This will lead to mounting challenges in continuing to rely on a critical system with software written in an archaic language requiring specialized skills.

It's enough to make one wonder if there's someone in the bowls of the IRS headquarters entering tax data on cuneiform tablets.

As the Tax Foundation's Scott Hodge wrote back in August, the tech problem isn't just big; it's downright crazy. And it's leading to problems elsewhere in the agency:

In her 2023 Report to Congress, the IRS's National Taxpayer Advocate (NTA) was quite critical of the IRS for failing to implement scanning technology to digitally input paper tax returns into the computer system. During this filing season, the IRS had a backlog of over 21 million paper returns that had to be keystroked into the computer system by hand. As the NTA wrote in her report, “In the year 2022, that doesn't just seem crazy. It is crazy.” [Emphasis original]. She strenuously recommended that scanning technology be acquired and implement in time for the 2023 filing season.

Because too many IRS employees are doing menial tasks, such as keystroking paper tax returns, they have too few employees answering the phones. According the NTA report, during the 2022 filing season, the IRS received 73 million phone calls for assistance. An IRS employee answered just 10 percent of those calls, or 7.5 million. Better technology and more customer service employees would certainly help address this problem. But so would a simpler tax code.

That last item – a simpler tax code – really is a big part of the many, growing and increasingly harrowing problems facing the IRS. A code simple enough for everyone to understand and broad enough to make sure everyone pays their share would go a long way to making everyone's life easier – taxpayers and tax collectors alike.

Until that day arrives, we had best get used to the IRS (sort of) running on the tech our grandparents designed and built.

The opinions expressed in this article are those of the author and do not necessarily reflect the positions of American Liberty News.

READ NEXT: Trump Exposed To Huge Legal Threat After New Move – What Will He Do Now?

No wonder I haven’t seen a refund since 2019.

I’m sure it’s true. When last I interviewed with a Government agency, my boss-to-be said to me: ‘They act like a nickel is $500.’ It makes you wonder where all the $$$ goes.