The Biden administration's student loan relief scheme has gotten a lot of press. But there are a couple of items that need to be repeated about this wave of the presidential wand.

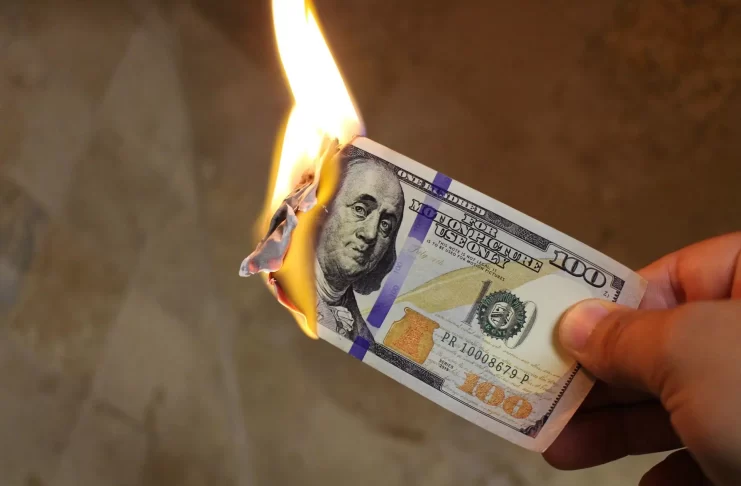

First, there's the cost to taxpayers, who foot the bill for federal student loans.

According to Bloomberg:

Penn Wharton estimates a one-time maximum debt forgiveness of $10,000 per borrower would cost roughly $300 billion if the relief is limited to those with incomes less than $125,000. The cost increases to $330 billion if the program is continued over a decade.

Eliminating the income threshold would raise the 10-year cost to $344 billion, while increasing the maximum amount forgiven to $50,000 per borrower would raise the total cost to as much as $980 billion, according to the analysis.

That's troubling enough – or at least it is to those who have long believed the federal debt was already too big and couldn't see why throwing $300 billion or more on the pile made any sense.

But a new wrinkle, and one that's sure to send politicians scrambling, is how some of those who get their loans forgiven may owe state taxes on what effectively becomes income. Again, from Bloomberg:

Residents of New York, Virginia and eleven other states could end up with a surprise tax hit of hundreds of dollars next year on forgiven student loans.

President Joe Biden's announcement that the government would forgive some student debt for individuals earning less than $125,000 was welcome news to many carrying large loan balances. But 13 states have laws that treat this forgiven debt as income, meaning that it's subject to state levies on earnings.

The full list of state where income taxes may be owed (and how much) can be found at the Tax Foundation website.

To be fair, states may scramble to exempt the forgiven loans from income taxes. But they need to act quickly, which could be difficult coming at this point in the year when most legislatures are not in session.

But to be even more fair, and blunt, this entire episode is a reminder that there's no such thing as a free lunch.

The opinions expressed in this article are those of the author and do not necessarily reflect the positions of American Liberty News.

READ NEXT: The Real Reason Gas Prices Are Falling >>

But 13 states have laws that treat this forgiven debt as income, meaning that it’s subject to state levies on earnings.

It is also taxable income at the Federal level.

No free lunch! You signed on the dotted line to pay. now pay what you owe. My children did

This is a hyped up concern. There is plenty enough wrong with this bribery scheme that we do not need to invent issues. All this means is that in 13 states (only 13) instead of getting $10,000, each recipient would net $9,500, if that depending on their actual income. It’s still free money for the,

The only thing that bothers me about this ews is that, again, that the citizens of states don’t overtax their constituents will be, yet again, subsidizing those that do.

Unless this has been changed, the IRS rules also tax debt which has been forgiven or written off. Maybe it was in the “magic wand” of Biden’s to exempt this giveaway from taxes.

Why would those who do not agree with paying others loans when they already had to pay their own want to pay their taxes? Where is the tea party when you need them? This must be why the IRS has more money and arms to collect taxes in the future. More grist for the Biden mill, grinding America down to dust.

States will be looking at forgiven loans as income, or gifts and taxed as such? I hope so.

So anyone who has their debts wiped out in bankruptcy should be taxed on their added “income?” Same logic, right?